13/10/2025 pre market

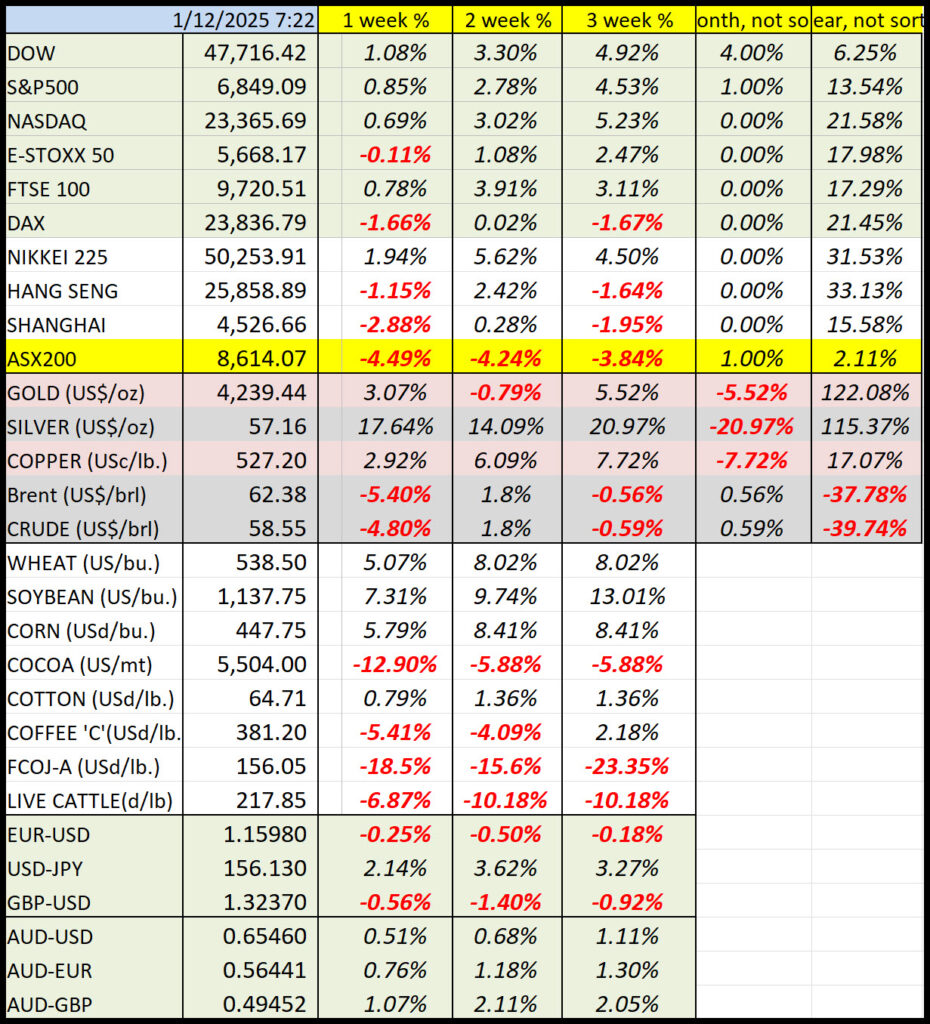

See past movements in the Global markets. Over the year, the Dow was UP +6.25%<+12.09% <6.7% Over the year, the S&P500 is UP 13.54%< 15,78%<17.03% the Nasdaq, the technology index UP 21.58%<19.28%<25.31% Our market

ASX200 over the year +2.11%<0.27%<5.72%<9.84%<8.6%<+9.06%

European markets: For the year, the STOXX 50, which comprises most major European Markets, was UP 17.9%<5.9%< 14.08%<12.46%<10.54%

Our DAILY 11market: ASX200, the market gauge for the top 200 stocks at the last trade, was 8614<8416<8769<9018

Commodities: over the year Gold is up 122%<109%<115.5%<96.96%<90.58% Overnight at US/Oz 4239<4058<4017.8<3759 Silver over the year is +115%<89.3%<81.39%<83.08% overnight at US/Oz 57.1<50.2<48.14<48.6<50.1<47.25<46.66<42.63 and copper the global economic barometer over the year at +17%<12.92%<8.68%<5.96%<3.16%< overnight at USc/lb 527<508<495<512<496<489<weeks b4.

Brent and WT Crude oil 62.38/58.55<62.42/57.9<63.63/59.75<65.9/61.5<61.29/57.5 US/barrel

Australian Dollar 65.5<64.9<65.1<65<64.7<65.4<65.5<64.90 previously.

13/10/2025 pre market

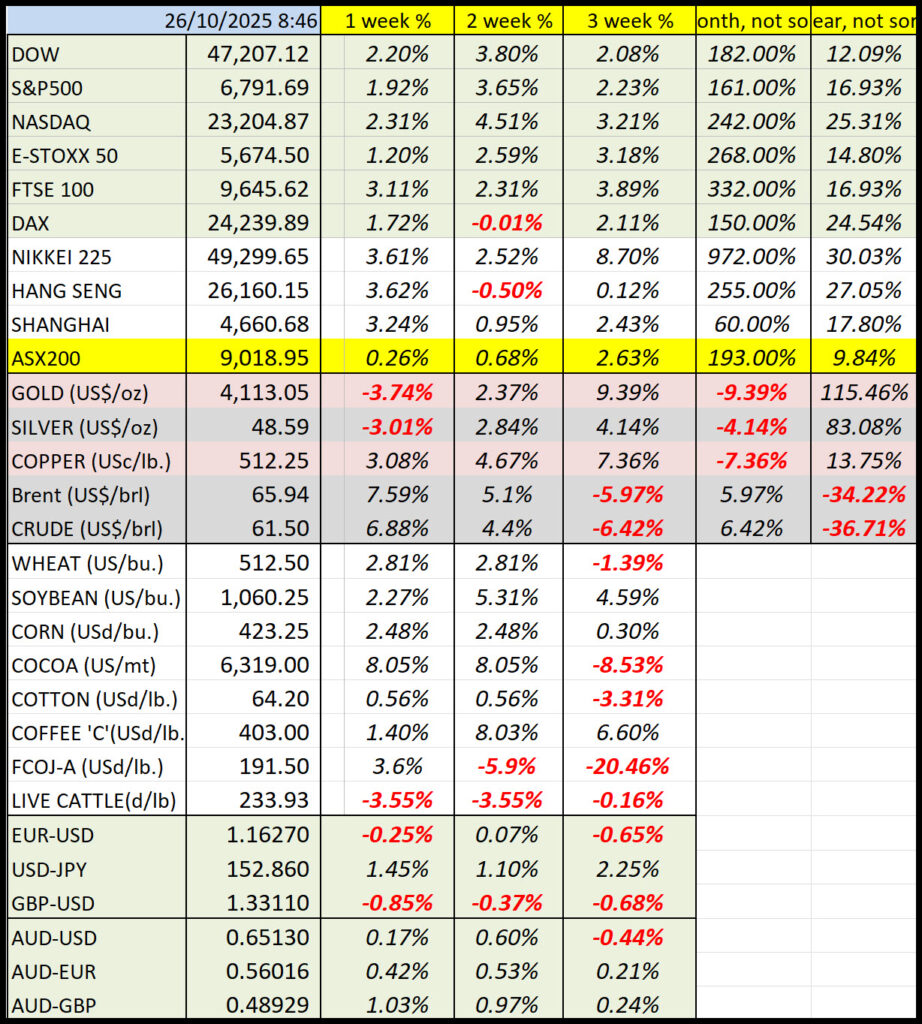

See past movements in the Global markets. Over the year, the Dow was UP +12.09% <6.7%<+6.1%<9.3% <10.7% Over the year, the S&P500 is UP 16.9%<13.63%<12.68%< 15,78%<17.03% the Nasdaq, the technology index UP 25.31%<22.6%<20.01%<24.0%<25.2% Our market ASX200 over the year +9.84%<8.6%<+9.06%<7.01%

European markets: For the year, the STOXX 50, which comprises most major European Markets, was UP 14.08%<12.46%<10.54%<8.53%<

Our DAILY 11market: ASX200, the market gauge for the top 200 stocks at the last trade, was 9018<8995<8958<8787<

Commodities: over the year Gold is up 115.5%<123%<110.5%<96.96%<90.58% Overnight at US/Oz 4113<4273<4017.8<3759<3638 Silver over the year is +83.08%<88.8%<60.63% overnight at US/Oz 48.6<50.1<47.25<46.66<42.63 and copper the global economic barometer over the year at +13.75%<10.36%<8.68%<5.96%<3.16%< overnight at USc/lb 512<496<489<477<weeks b4.

Brent and WT Crude oil 65.9/61.5<61.29/57.5 US/barrel

Australian Dollar 65.1<65<64.7<65.4<65.5<64.90 previously.